The 5 Biggest Tax Mistakes Small Business Owners Make

Owning your own business can be rewarding, but as most entrepreneurs know, it also means a lot of work, much more than a traditional salary-based job working for someone else. With all the responsibilities, a well-meaning business owner is still at risk of making a regrettable tax mistake. Whether a business is incorporated and files […]

The Top 5 Accounting Mistakes By Small Business Owners

Small business owners face numerous everyday challenges, and they usually conquer them with their entrepreneurial strength. Unfortunately, keeping the books on their growing business is not a skill someone can simply persevere through and get it right. The potential consequences of messing up on the accounting functions can be serious when it comes to the […]

Does Your Company Need to File Form 1095-B?

A company is responsible for filing IRS Form 1095-B only if two conditions apply: It offers health coverage to its employees, and it is “self-insured.” This means that the company itself pays its employees’ medical bills, rather than an insurance company. A company that doesn’t meet both conditions won’t have to deal with Form 1095-B. […]

2016 Standard Mileage Rates for Business, Medical and Moving

The Internal Revenue Service has issued the 2016 standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. Beginning on Jan. 1, 2016, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 54 cents per mile […]

The 5 Most Common Payroll Mistakes by New Businesses

There are payroll mistakes that benefit employees, as well as those that benefit employers. But either way, a mistake is a mistake. If you come across any type of mistake, such as overpaying or underpaying employees, it is imperative to act fast, discuss the situation with your workers, and provide a remedy that will allow […]

Year End Tax Tips for Businesses

The National Society of Accountants is offering some year end tax tips for businesses. Consider several general strategies, such as use of traditional timing techniques for income and deductions and the role of the tax extenders, as well as strategies targeted to your particular business. As in past years, planning is uncertain because of the […]

Top Ten Year End Tax Planning Tips

The end of the year is a good time to evaluate your tax obligations so there are no surprises come filing time. Check out these top ten year end tax planning tips for what to keep in mind as you review your finances. Check on Congress The most important thing you can do this year […]

Tax Tips for Your Rental Property or Vacation Home Rental

Owning a rental property is one way to boost your income and secure your financial landscape. You may also have a golden opportunity for some serious tax breaks. Rental properties – both full time, part time, and vacation homes – can be a wealth of tax savings. Is This Tax Deductible? The key to saving […]

When to Lease Business Equipment Instead of Buying

As things stand now, the tax breaks for buying depreciable business property have been watered down for the 2015 tax year. Consider leasing business equipment instead of buying it. Generally, you can write off the entire cost of leasing without a huge upfront commitment. Also, leasing isn’t forever. If the tax breaks for buying property […]

Five Tax Tips for New Businesses

If you start a business, one key to success is to know about your federal tax obligations. You will need to know not only about income taxes but also about payroll taxes and applicable state and local taxes. Here are five basic tax tips that can help get your business off to a good start. […]

Deducting Losses from a Disaster on Your Tax Return

Massive flooding of Texas and Oklahoma has caused widespread damage to businesses and homes. If you suffer damage to your home or personal property, you may be able to deduct casualty losses you incur on your federal income tax return. Here are 10 tips you should know about deducting losses: 1. Casualty loss. You may […]

Dallas CPA Tip: Protect Your Documents for Disaster

This year has seen its share of natural disasters. From tornadoes to earthquakes to flash floods, it seems few regions are immune this spring. Adding to the anxiety is peak tornado season, and locally, possible evacuations for Denton county residents due to flooding. The volatile weather patterns have caused many to access their disaster preparedness […]

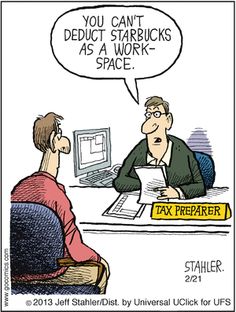

Taking the Home Office Deduction for 2014

If you use your home for business, you may be able to deduct expenses for the business use of your home. If you qualify, you can claim the deduction whether you rent or own your home. If you qualify for the deduction you may use either the simplified method or the regular method to claim […]