Tax Deductible Donations Go Further on North Texas Giving Day

As we get closer to the end of the year, charitable organizations and nonprofits start gearing up for year end fundraising, since many people wait until the end of the year to make their tax deductible donations. The holiday season tends to bring out more charitable attitudes of the general public. However, North Texas has […]

Ten Things to Know About Identity Theft & Your Taxes

Learning you are a victim of identity theft can be a stressful event. Identity theft is also a challenge to businesses, organizations and government agencies, including the IRS. Tax-related identity theft occurs when someone uses your stolen Social Security number to file a tax return claiming a fraudulent refund. Many times, you may not be […]

What You Need to Know About the Child and Dependent Care Credit

Day camps are common during the summer months. Many parents pay for them for their children while they work or look for work. If this applies to you, your costs may qualify for a federal tax credit that can lower your taxes. Here are the top things to know about the Child and Dependent Care […]

Dallas CPA Tip: Protect Your Documents for Disaster

This year has seen its share of natural disasters. From tornadoes to earthquakes to flash floods, it seems few regions are immune this spring. Adding to the anxiety is peak tornado season, and locally, possible evacuations for Denton county residents due to flooding. The volatile weather patterns have caused many to access their disaster preparedness […]

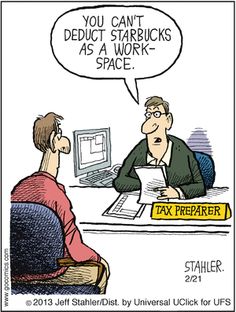

Taking the Home Office Deduction for 2014

If you use your home for business, you may be able to deduct expenses for the business use of your home. If you qualify, you can claim the deduction whether you rent or own your home. If you qualify for the deduction you may use either the simplified method or the regular method to claim […]

What You Should Know about the Child Tax Credit

The Child Tax Credit may save you money at tax-time if you have a qualified child. Here are the top things you should know about the credit. Amount. The Child Tax Credit may help reduce your federal income tax by up to $1,000 for each qualifying child that you are eligible to claim on your […]

Make A Mistake? How & When to Amend Your Tax Return

Don’t worry if you made a mistake on your tax return or forgot to claim a tax credit or deduction. Or maybe a financial institution sent out corrected 1099 statements for your investments. You can fix it by filing an amended return. Here are 10 tips that you should know about amending your federal tax […]

Business or Hobby? Tax Tips for Reporting Side Income

Millions of people enjoy hobbies that are also a source of income. Some examples include stamp and coin collecting, craft making, and horsemanship. You must report on your tax return the income you earn from a hobby. The rules for how you report the income and expenses depend on whether the activity is a hobby […]