Why we put off filing our taxes and how to stop it.

The 2017 tax filing season has been officially underway for just more than a week. Lots of folks have already filed their returns. And, according to ecstatic posts on social media, some have received their refunds. Other taxpayers, however, are waiting to file. Form-ulaic delay: Why the delay. In a lot of cases, folks haven’t yet […]

10 Easy End of Year Tax Tips to Increase Your Tax Refund

It’s hard to believe that the holiday season is already upon us and the year will be coming to a close soon! Now is a great time to make some end of season tax moves to help lower your tax bill and increase your tax refund come tax time. Once the year ends, so do most […]

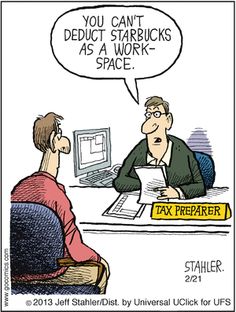

Taking the Home Office Deduction for 2014

If you use your home for business, you may be able to deduct expenses for the business use of your home. If you qualify, you can claim the deduction whether you rent or own your home. If you qualify for the deduction you may use either the simplified method or the regular method to claim […]

Tax Rules for Children with Investment Income

Normally, you must pay income tax on your investment income. While this is also true for a child who must file a federal tax return, if a child can’t file his or her own return, their parent or guardian is normally responsible for filing their tax return. Special tax rules apply to certain children with investment […]

Itemized vs. Standard Deduction

When we finish preparing a client’s tax return, sometimes he or she is confused about whether the medical expenses were deducted or if their charitable deductions applied. When preparing your tax return, you have a choice whether to itemize deductions or take the standard deduction. Before you choose, it’s a good idea to figure your deductions using both […]